Sustainability consulting is a rapidly evolving discipline. Client needs are becoming more complex and disclosure expectations keep expanding. At the same time, given current economic and political headwinds, many sustainability budgets have shrunk, meaning external consultants are often expected to do more with less.

As AI becomes more sophisticated, many consultants are facing mandates from leadership to start embedding AI into existing processes, but in a way that reduces risk, strengthens trust with clients, and improves delivery without compromising professional judgment.

Now, alongside existing client work, ESG consultants are talking to colleagues and researching late into the night, looking for the best AI tools to help them deliver better outputs with fewer inputs. We’ve written a separate guide to automating ESG consulting work, but here, we’re listing our top AI tools for ESG consultants, by category/function.

Why AI is becoming necessary for ESG consultants

Most ESG consulting firms are being asked to do more with less. For their own firms, and their clients, expertise is becoming costly, so individual team members often find themselves doing more work than one person can realistically take on.

At the same time, client work now means far more than just reporting on carbon emissions or setting goals and targets. Most client engagements involve the full spectrum of ESG risks and opportunities, covering biodiversity, workforce, governance, supply chains, and enterprise risk, and using these insights to inform detailed, tangible action plans.

Existing manual processes and human team members can struggle when put under this kind of pressure. Managing workflows in spreadsheets, reviewing documents individually, and conducting customized analyses manually can lead to teams being held up by human bottlenecks. It’s not just speed; manual processes can be risky, especially when mistakes in data and assessments carry regulatory and reputational consequences.

There is also a competitive shift underway. Clients are increasingly aware of ESG software platforms that promise faster insights at lower cost, and may see these as a viable alternative to hiring human expertise. Consultants who rely solely on manual effort risk being outpaced by teams that combine expertise with automation.

At the same time, consultants can use AI not just to drive down costs but to offer unparalleled insight and thought leadership. With the right tools, consultants can spot trends and conduct proprietary analysis that positions them as industry leaders.

AI offers leverage where consultants need it most. It can process large volumes of information, surface patterns across peers and regulations, automate repetitive checks, and help consultants stay on top of rapidly evolving ESG trends, allowing team members to focus on interpreting what these external realities mean for their clients, and then proposing better strategies.

Using AI in a way that reduces risk

Adopting AI in ESG work comes with responsibility. Poorly governed automation can create more problems than it solves, introducing errors, reducing transparency, and ultimately undermining trust if outputs cannot be explained or defended.

The strongest approach is human-first by design. AI should handle time-consuming and repeatable tasks behind the scenes, while consultants remain accountable for conclusions, advice, and client communication.

In practice, this means using AI to accelerate research and analysis, while keeping humans firmly in the loop for materiality decisions, assumptions, and narrative development. It also means experimenting with and evaluating tools in a systematic way, looking for the solutions that best meet your team’s needs and expectations. When implemented thoughtfully, AI enhances the client experience by making work faster and more consistent without making it feel automated.

How leading ESG consultants are integrating AI today

Leading ESG consultancies are already embedding AI across the full lifecycle of client engagements and learning how to scale rapidly with AI. These teams use AI early in their client engagement process to assess disclosure maturity and regulatory readiness. During implementation, AI tools support data validation, peer comparison, and framework alignment. In reporting cycles, they help teams track changes, check consistency, and manage growing disclosure complexity.

Outside of direct client work, ESG consultants can use AI tools to help business development and marketing efforts, like market research, allowing them to differentiate themselves in the market with unparalleled insights and thought leadership.

While many of the AI-powered ESG platforms on the market are ultimately purchased and owned by clients, consultants still play a critical role in making those platforms effective.

Consultants typically help clients select the right platform, design the data model, configure workflows and controls, and build reporting templates inside the client’s own environment. In early reporting cycles, consultants often act as power users while internal teams build confidence, before ongoing operation shifts in-house.

AI makes this transition smoother by reducing manual effort and improving consistency from day one.

What do we mean by an AI tool?

Not all ESG software uses AI in the same way. Some platforms are built around AI from the ground up, while others integrate AI into more traditional systems to improve speed and accuracy.

Broadly, the market falls into two categories. AI-first platforms redesign core workflows around automation and machine learning. AI-enabled platforms embed AI features into established products to enhance existing functionality.

Both approaches can be useful, depending on the client context and the consultant’s role.

Top AI tools for ESG consultants

Sustainability intelligence

Manifest Climate

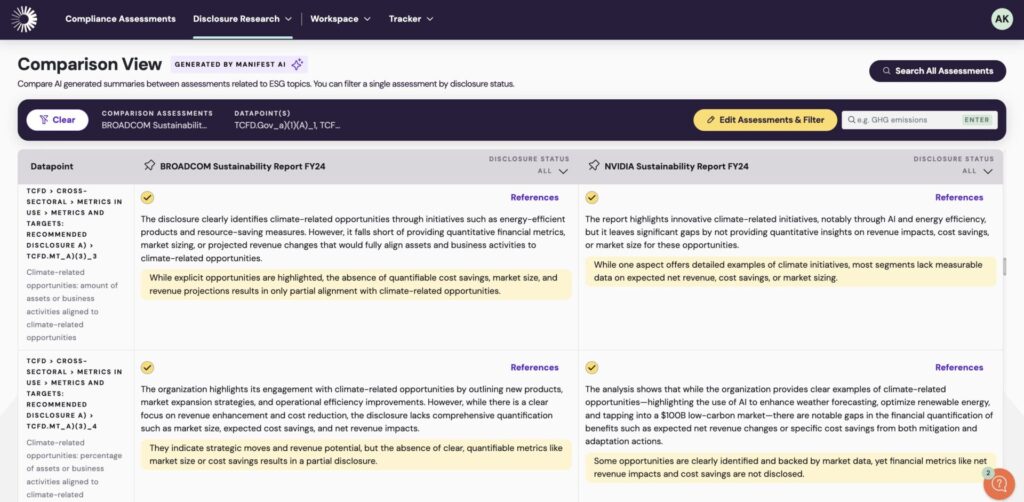

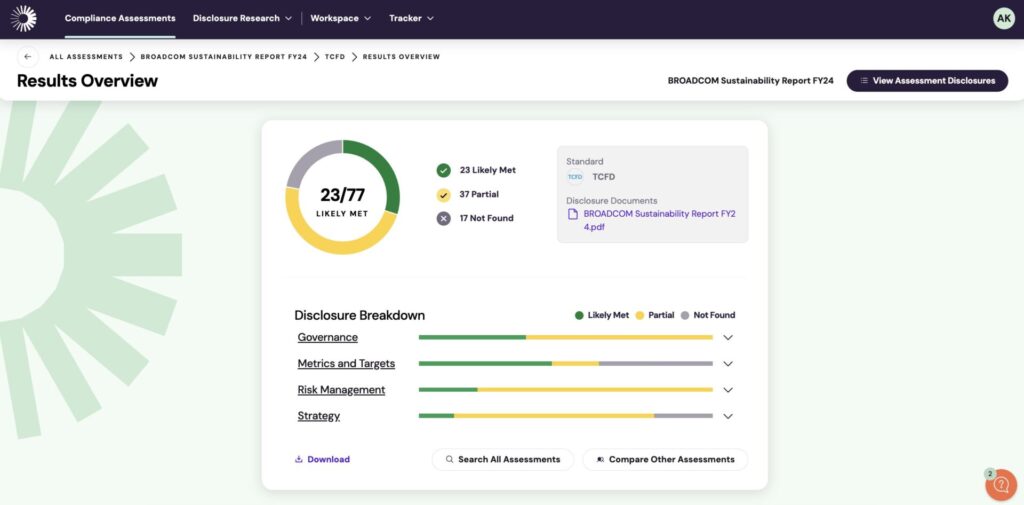

Manifest Climate is an AI-powered sustainability intelligence platform designed specifically for ESG and sustainability consultants. It uses AI to parse public and privately uploaded disclosures, map them to regulatory requirements, and compare performance against peers, sectors, and supervisory expectations.

ESG consultants use Manifest Climate to run faster diagnostics and gap analyses, conduct first-pass alignment audits, and ground recommendations in evidence rather than manual document review.

Learn more about how Manifest Climate works or book a demo here.

Generic AI platforms

ChatGPT, Claude, & Microsoft CoPilot

Most ESG consultants are already experimenting with general-purpose AI tools like ChatGPT, Claude, and the broader OpenAI ecosystem. These tools are widely accessible, easy to use, and genuinely helpful for many everyday tasks.

In practice, consultants often use generic AI to summarize regulations, draft early outlines, rework client-facing language, sanity-check assumptions, or brainstorm structure for reports and presentations. Used carefully, they can save time and help teams move faster through low-risk, low-context work.

However, consultants will pretty quickly run into issues when trying to use these generic AI tools for domain-specific tasks, like disclosure analysis or benchmarking at scale.

In-house tools

Some consulting firms are building AI tools in-house to gain flexibility and tailor workflows to their own methodologies. While this can work, it comes with a high opportunity cost: teams must invest heavily in data, engineering, governance, and ongoing maintenance, often recreating capabilities that already exist. For many ESG consultants, purpose-built platforms like Manifest Climate offer a more practical middle ground, delivering domain-specific AI without the risk and distraction of building from scratch.

ESG and carbon data platforms

Pulsora

Pulsora positions AI at the centre of its ESG data platform, with tools for metric mapping, anomaly detection, and decarbonization modelling. Its AI supports framework alignment and data quality checks across complex ESG datasets. Consultants might use Pulsora when helping clients design scalable ESG data models and reporting architectures.

Persefoni

Persefoni focuses on AI-enabled carbon accounting, automating emissions calculations and data handling across Scope 1, 2, and 3. The platform is built for accuracy and auditability at scale. Consultants typically deploy Persefoni for clients facing regulatory or investor scrutiny around carbon data.

Watershed

Watershed uses AI to support Scope 3 estimation, supply-chain emissions analysis, and product footprinting. Its tools are designed to help organizations move from measurement to decarbonization planning. Consultants often pair Watershed with climate transition planning and target-setting work.

Greenly

Greenly offers an AI-powered engine that automates data ingestion and scenario analysis for carbon reporting. Its tooling prioritizes speed and accessibility, particularly for mid-market organizations. Consultants use Greenly when clients need to stand up carbon reporting quickly with limited internal resources.

Enterprise ESG platforms with integrated AI

IBM Envizi

IBM Envizi is an enterprise ESG data and planning platform with AI-infused forecasting and analytics. AI enhances insights and planning, while the platform remains rooted in traditional enterprise data management. Consultants typically support complex implementations and integrations across large organizations.

Microsoft Sustainability Manager

Microsoft Sustainability Manager combines ESG data management with AI-powered insights and scenario analysis. Generative AI features support exploration and what-if analysis across sustainability metrics. Consultants often configure the platform to align with broader Microsoft data environments.

SAP

SAP’s sustainability tools embed AI into reporting, controls, and compliance workflows. AI is used to support checks, reporting automation, and data consistency. Consultants help tailor SAP sustainability modules to regulatory and enterprise reporting requirements.

ESG reporting and compliance workflows

Workiva

Workiva is a reporting and collaboration platform that has added AI for drafting, linking, and validation across ESG and financial disclosures. AI improves efficiency and consistency rather than replacing core reporting workflows. Consultants may use Workiva to manage complex, multi-stakeholder reporting processes.

Diligent

Diligent ESG integrates AI-assisted analytics into governance, risk, and compliance workflows. Its AI capabilities support oversight and monitoring rather than deep data modelling. Consultants use Diligent in governance-led ESG and board-level reporting engagements.

Nasdaq Metrio

Nasdaq Metrio focuses on sustainability reporting and performance tracking, with increasing use of AI for data handling. Automation reduces manual effort across reporting cycles. Consultants typically support configuration and framework alignment.

Novisto

Novisto offers AI-assisted ESG data management and analytics to support structured reporting across multiple standards. Its tooling helps organizations manage metrics and narratives in one system. Consultants often use Novisto during CSRD and multi-framework reporting builds.

Why 2026 is the ideal time to adopt AI tools

By 2026, many ESG platforms have moved beyond experimentation into more mature, reliable AI capabilities. Models are more accurate, workflows are better designed, and governance controls are clearer.

For consultants, this is an ideal time to test tools, refine internal processes, and decide where AI genuinely adds value for clients. The advantage comes from using the right tools in the right places, not from adopting everything at once.

| Case study: How PwC uses Manifest Climate’s AI to speed up ESG advisory work PwC’s sustainability teams work with large volumes of client disclosures across multiple frameworks and jurisdictions. A significant amount of consultant time is traditionally spent reviewing past reports, benchmarking peers, and working out how evolving requirements like the Corporate Sustainability Reporting Directive (CSRD) and International Financial Reporting Standards (IFRS) S1 and S2 apply in practice. By integrating Manifest Climate into Microsoft Copilot, PwC consultants can access trusted, expert-curated sustainability data directly within their existing workflows. Instead of manually searching through documents, teams can quickly understand what clients are disclosing, how they compare to peers, and where gaps exist, using AI that is grounded in structured ESG data rather than generic language models. This setup allows PwC consultants to spend less time on manual research and more time on interpretation, stakeholder conversations, and advice. AI accelerates the analysis in the background, while consultants retain full control over judgment, narrative, and client-facing recommendations. -> Read the story |

Manifest Climate: The ESG consultant’s ultimate AI companion

AI should support how ESG consultants work, not replace why clients hire them. The goal is sharper insights, faster diagnostics, and more time spent on high-value advisory work.

Manifest Climate is designed to sit alongside consultants as an AI-powered research and benchmarking layer that is transparent, defensible, and easy to explain to clients.

If you want to see how it fits into modern ESG consulting workflows, book a demo and explore how it can support your team and your clients in 2026 and beyond.