Companies are under growing pressure from investors, customers, and regulators to disclose their greenhouse gas (GHG) emissions. This data is essential for understanding just how much each business contributes to climate change and for establishing credible emissions-reduction targets, a key part of any organization’s broader climate plan. It also allows companies to benchmark their progress […]

GFANZ Wants to Whip Portfolio Alignment Metrics into Shape

Our climate future is unknown territory. Still, financial institutions want to plot a course to its coolest fringes. Hence the buzz over portfolio alignment metrics (PAMs) — the measurement systems firms can use to understand what investment, lending, and underwriting activities support a 1.5°C warming pathway. Banks, asset managers, asset owners, and insurers want PAMs […]

Weekly round-up: August 1-5

The top five climate risk stories this week 1)Worst-case climate scenarios “dangerously underexplored” Extreme climate change outcomes are “under-studied and poorly understood,” a group of scientists have warned. In a paper published Monday, they argue that a “Climate Endgame” research agenda is needed to explore the worst-case outcomes of catastrophic global warming. These include famine and undernutrition, […]

Climate risk regulation rundown: July 2022

What happened in climate-related financial regulation last month, and what’s coming up The Financial Stability Oversight Council (FSOC), the US’ top financial regulatory body, received an update on its member agencies’ efforts to combat climate-related risks at a meeting on July 28. The FSOC published a factsheet following the meeting outlining the “considerable progress” made advancing the panel’s recommendations on […]

Weekly round-up: July 25-29

The top five climate risk stories this week 1) Banks falling short of Paris climate goals Banks have to speed up their decarbonization efforts if they are to align with climate pathways set out by the 2015 Paris Agreement, an analysis conducted by two investor groups shows. The Institutional Investors Group on Climate Change (IIGCC) […]

Yes, the FSOC *is* a tool to address climate change

The regulatory body has an explicit duty to respond to emerging threats to the stability of the US financial system. Climate change is one such threat. US financial regulators have been playing catch up on climate risk for much of President Biden’s time in the White House. By some measures, they have made good progress since […]

What OSFI’s Draft Climate Risk Guideline Means for Canadian Financial Institutions

On May 26, Canada’s federal financial regulator released a draft guideline that outlines how nationally regulated financial firms should both manage and disclose their climate risks. As part of the draft guideline, the Office of the Superintendent of Financial Institutions (OSFI) lays out six climate governance and risk management principles, as well as six climate-related […]

Weekly round-up: July 18-22

The top five climate risk stories this week 1) OS-Climate unveils risk and investing tools A climate data initiative backed by Amazon, Microsoft, Goldman Sachs, and other major corporations on Wednesday debuted three new tools to help financial institutions facilitate the net-zero transition. OS-Climate, a non-profit set up by open source technology group the Linux Foundation, wants […]

How herd behavior could imperil the low-carbon transition

Financial stability risks could arise if banks and investors all take the same route to decarbonize their portfolios “When the herd moves, it moves.” UK Prime Minister Boris Johnson used this phrase in his July 7 resignation speech to describe how political support flooded away from him in the wake of one too many scandals. It is also […]

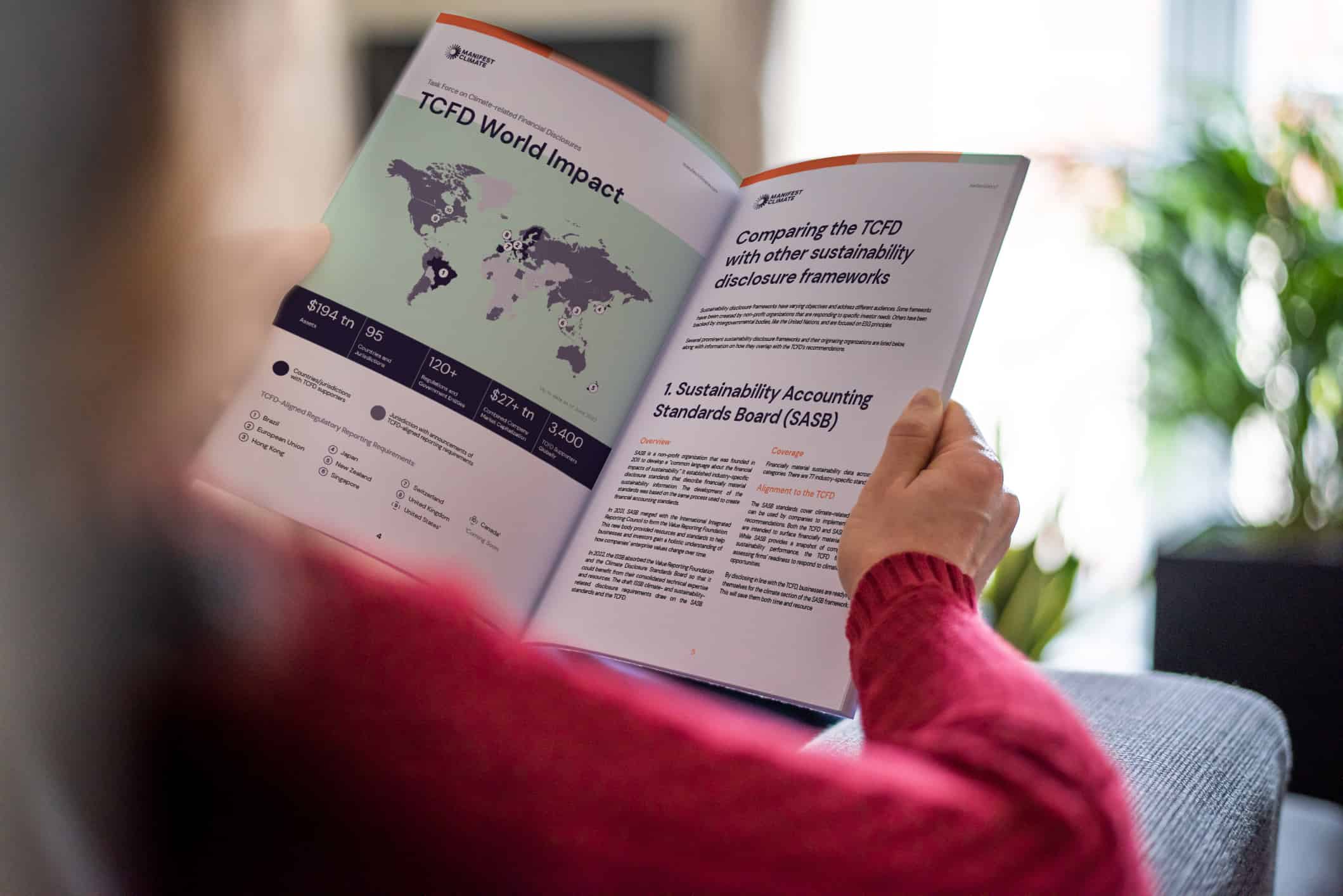

How the TCFD Stacks Up Against Other Sustainability Frameworks: A White Paper

There are plenty of sustainability frameworks for companies to adhere to when it comes to reporting their climate-related risks and opportunities. However, the Task Force on Climate-related Financial Disclosures (TCFD) ranks ahead of the others and is the gold standard when it comes to climate reporting. What are the most common sustainability frameworks? Our white […]