Data is essential to businesses’ efforts to build climate resilience and fulfill their low-carbon ambitions. It’s also vital for understanding how climate threats could imperil the wider economy and financial system.

In July 2023, the Financial Stability Board — a global panel of regulators — said consistent, high-quality, and comparable data is crucial for monitoring and assessing climate-related risks.

But in order for data to be useful to decision-makers, it must be considered within the broader context of climate policy, regulation, and market changes. This is how business leaders can separate signal from noise and gain valuable insights to power their organizations’ climate strategies.

Exploring our Climate Disclosure and Investor Trends

Manifest Climate’s Disclosure and Investor Trends is a must-read series of articles that explores data from companies’ climate-related disclosures and quarterly earnings calls. Each week, our experts track key data points, identify common themes, and provide valuable context on what they mean for businesses.

With Disclosure Trends, organizations can stay on top of how other companies are talking about climate risks and opportunities and uncover the latest developments in climate metrics and targets. Meanwhile, Investor Trends sheds light on the climate-related issues that preoccupy CEOs and investment analysts, as well as how these issues are changing over time.

Together, Disclosure and Investor Trends can help organizations of all sizes supercharge their climate strategies and address potential risks and opportunities more effectively.

What’s the latest in climate disclosure trends?

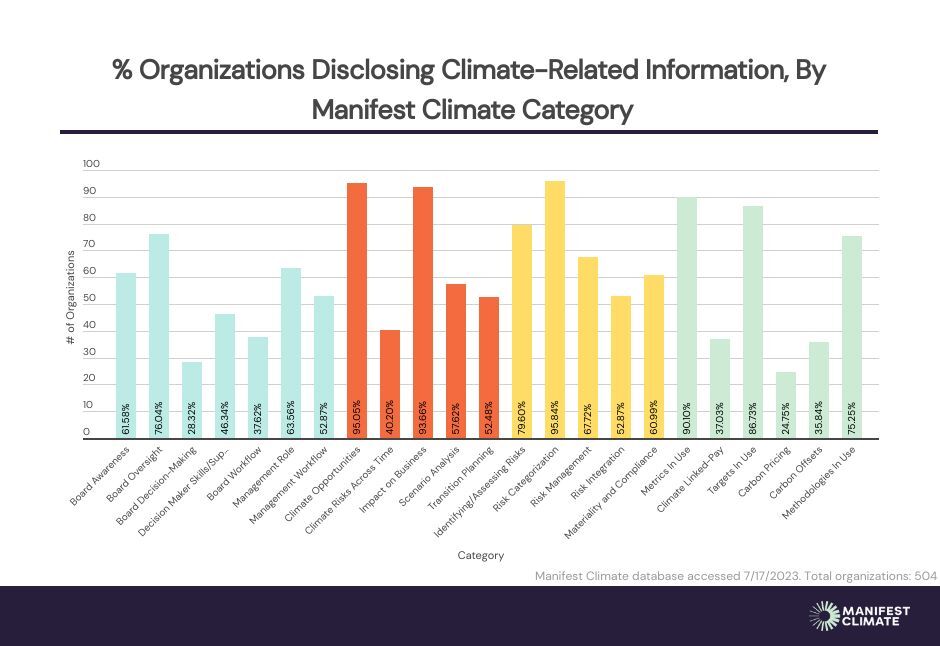

For a taste of what’s available, here’s a snapshot of Manifest Climate’s disclosure database, which reveals the rates of reporting for specific climate action categories. These categories have been organized into the relevant pillars set out by the Task Force on Climate-related Financial Disclosures (TCFD), the world’s premier climate reporting framework.

Climate Governance

Out of around 500 organizations assessed from 13 sectors, just over half share information aligned with the seven relevant climate governance categories in the Manifest Climate methodology on average. However, some categories receive far more attention from companies than others.

For instance, while over three-quarters of companies say their board oversees climate issues, a much smaller proportion — 38% — have well-defined processes for their board to be informed of climate risks and to consider both climate risks and opportunities in decision-making. This suggests many companies may not have the necessary mechanisms and procedures for effective board oversight — despite their claims to the contrary.

Climate Strategy

Sixty-eight percent of companies disclose TCFD-aligned strategy information. Almost all describe at least one climate opportunity in their public disclosures, which shows that most businesses understand they could benefit from the shift to a low-carbon future.

However, only four in 10 organizations identify specific climate threats over well-defined time horizons, and just over half disclose information on their climate transition plans. This absence of detail implies significant gaps in companies’ climate management.

Climate Risk Management

A majority of organizations also report climate risk management information, although not all at the same level of granularity. While 96% of organizations say they are assessing or managing at least one climate risk to their businesses, barely half provide evidence that their climate risk management processes are integrated with their overall enterprise risk management.

Firms that don’t incorporate climate in their risk management frameworks may be storing up trouble for the future, as they may miss how climate risk drivers could interact with, and exacerbate, existing business risks.

Climate Metrics and Targets

Regarding metrics and targets disclosures, 90% of organizations report at least one climate-related metric, like a greenhouse gas emissions number or an energy intensity level. A nearly equal proportion of businesses also claim to have a climate target in place. Still, many of these disclosures lack detail or explanations of the methods used to establish them.

Disclosure levels also vary across sectors. For example, consumer-centric companies and financial firms report climate targets at far lower rates than materials, utilities, and energy companies. This makes sense considering external pressures to decarbonize have focused on these emissions-intensive industries more than others.

Go deeper into climate data

This high-level view of Manifest Climate’s database shows that climate-related concerns are widely addressed in corporate disclosures. It also highlights the wide variation in disclosure rates across different climate action categories and sectors, emphasizing the need for companies to dig into the details to discover valuable insights for decision-making.

Our new Disclosure and Investor Trends helps you do exactly that. Our methodology categorizes climate-related information into over 100 criteria, so you can be sure you’re getting the most detailed look into corporate reporting practices.

Building climate competence

Manifest Climate helps organizations stay ahead of the curve with data-driven insights that cover the latest themes in climate disclosure and investor communications. Our Resources module is also packed with business-relevant climate news, explainers, and internal and external tools to supercharge your climate strategy.

Ready to learn more? Book a free demo today.