We’re often asked what makes Manifest Climate better than other AI tools on the market, like ChatGPT, Claude, or Microsoft Copilot. Here’s our explanation.

Firstly, what is Manifest Climate?

Manifest Climate is an AI-based sustainability intelligence platform that helps financial institutions and consultants conduct rigorous ESG analyses at scale.

Manifest Climate is an AI tool that was specifically built for sustainability analysis. Many sustainable investment teams and ESG consultants already use general AI tools like ChatGPT for parts of their day-to-day work, which naturally raises the question of why those same tools fall short when it comes to deeper, more analytical tasks.

It’s a good question. Generic AI tools are good at many things, but there are several reasons not to entrust them with large-scale ESG analysis.

What should you use generic AI for?

Generic AI is well-suited to broad, low-friction tasks. It can help teams find information, summarize long documents, draft early ideas, answer basic questions, and support exploratory strategy work without much setup.

The limitations show up once context really matters. Generic models don’t arrive with an understanding of how a sustainability question should be framed, which standards apply, or what’s already known about a company, sector, or set of disclosures.

For sustainability work that needs consistency, defensibility, and repeatability, depth comes from clearly defined criteria, shared context, and alignment with established frameworks. Generic AI is built for many things, but it’s not built for this. These tasks call for purpose-built, specialist AI tools.

➡️ Read our explainer on the difference between generic and specialist AI tools

Why shouldn’t you use ChatGPT to analyze sustainability performance?

ChatGPT is confident, even when it’s wrong

A key issue with generic AI tools is that they don’t tell you when they’re not sure. They deliver every answer with the same confident tone, whether it’s true or not. You can try asking for confidence scores, but those numbers don’t reliably tell you how much trust to place in the result.

This is mostly harmless for tasks like brainstorming and summarizing, but it becomes a serious issue once the output feeds into decisions with real consequences, such as allocating capital or prioritizing investments. For tasks like benchmarking, disclosure gap analysis, or custom sustainability assessments, hallucinations or inaccuracies introduce real risk.

Sustainable investment teams and ESG consultants need tools with guardrails — code-based checks on the model’s outputs that ensure that the model is not going outside the bounds of what it’s trained to do. In a tool like Manifest Climate, these guardrails act as an additional layer of fact-checking, ensuring that what the model says is indeed supported by the evidence.

ChatGPT lacks context

For sustainable investment and stewardship teams, as well as ESG consultants, ‘context’ for sustainability analysis comes from the rules, frameworks, and internal assumptions that shape how sustainability is evaluated, whether that’s a regulatory standard, a disclosure framework, or your own investment and risk criteria.

General AI tools don’t have that perspective baked in. They treat every question as a fresh request, without understanding which signals matter most to your team or how you define success. Manifest takes a different approach. Client methodologies are built directly into the system, so assessments reflect your priorities and your way of interpreting sustainability data, rather than a generic model’s default logic.

At the same time, most sustainability data lives inside of PDFs, but rarely in an accessible way. Sustainability information is often contained in qualitative disclosures or in graphically designed tables, footnotes, and diagrams that can trip up general AI tools. Manifest Climate’s extraction process is designed to pull relevant quantitative and qualitative information, no matter how complex the file.

ChatGPT’s data security lacks transparency

Most general AI tools weren’t built with sensitive ESG work in mind. Sharing internal reports, draft disclosures, or proprietary analysis through tools like ChatGPT or Claude can create real data-handling risk. By default, prompts may be retained and used to improve future models, which means confidential information can end up feeding systems you don’t control. For teams working with regulated, investor-facing, or commercially sensitive ESG data, that uncertainty is hard to ignore.

ChatGPT can’t scale

General-purpose AI is built around single prompts and single answers. That works fine for isolated questions, but it starts to fall apart when teams need to do the same analysis repeatedly and at scale. Run identical questions across multiple companies, reports, or time periods, and the results rarely line up cleanly. Instead of saving time, teams end up double-checking, normalizing, and reconciling outputs by hand just to make them usable.

At the same time, a tool like ChatGPT also has token limits, meaning it can only handle a certain amount of data uploaded before its responses start to get incoherent. If you’re an analyst looking for insights across hundreds of sustainability reports, you need something more robust than ChatGPT.

Example: Analyzing sustainability performance with ChatGPT vs. Manifest Climate

Let’s consider the following scenario:

You are a sustainability analyst looking to compare the ESG performance of two different companies in the semiconductors sector, Nvidia and Broadcom. You upload both companies’ sustainability reports (which are each +40 pages long) to ChatGPT and ask it questions.

ChatGPT sounds confident in answering your questions, but when you compare what it tells you against the source documents, you’ll find that the answers it provides are typically only 50% correct at best. If you ask the same question twice, you’re likely to get a different answer each time. If you ask for a year-on-year comparison, you won’t get an apples-to-apples comparison. And if you try to ask multiple questions across multiple different documents, you’ll soon see that it all but breaks from the pressure.

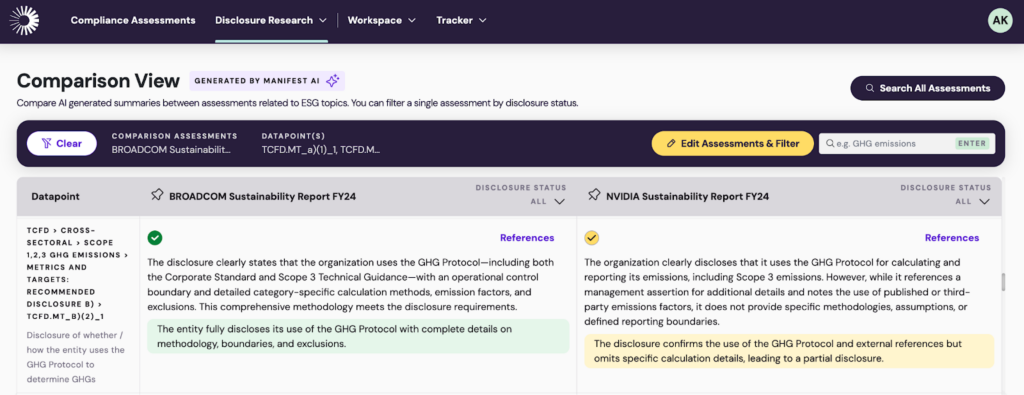

Using ChatGPT vs. Manifest Climate to understand how two companies use the GHG Protocol to determine greenhouse gases

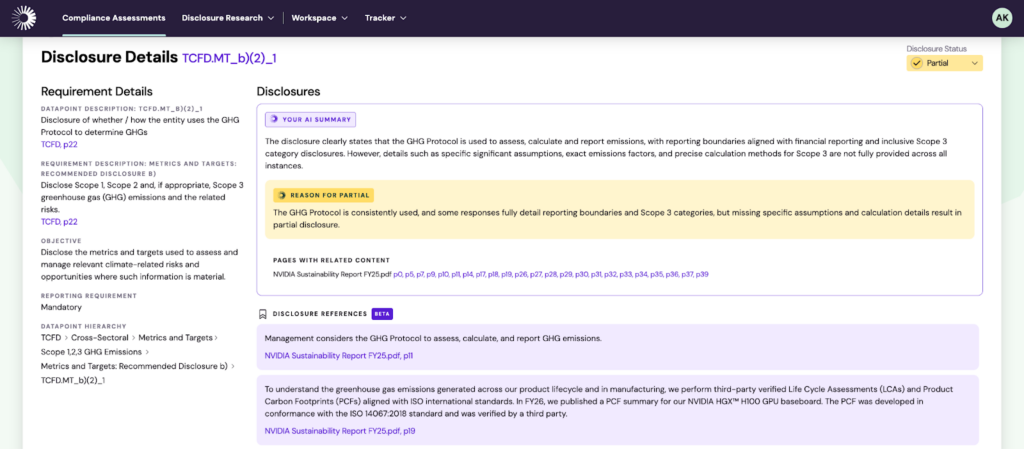

In this example, we’ve used Manifest Climate to compare two companies, Broadcom and NVIDIA, on their disclosure around GHG Protocol usage.

Manifest Climate allows users to compare the two companies directly against this particular TFCD recommendation.

Manifest Climate shows: A detailed disclosure for Broadcom that meets TCFD governance and metrics requirements, and a partially met disclosure for NVIDIA. For NVIDIA, the platform provides clear context on where specific calculation methodologies are omitted, enabling users to drill down into the gaps and understand precisely which TCFD requirements are not fully addressed. Manifest Climate can benchmark multiple companies at once (from a handful like this example to hundreds at once) analyzing detailed datapoints across regulatory frameworks and custom methodologies.

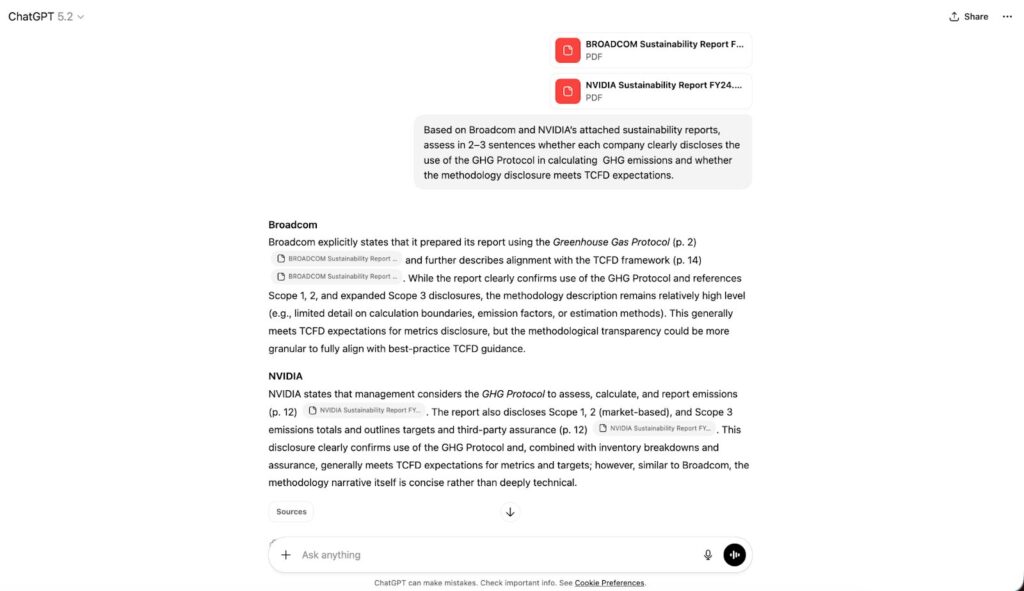

Meanwhile, attempting the same analysis in ChatGPT doesn’t generate nearly the same output.

ChatGPT shows: A generalized summary without explicit compliance judgments, making it unclear whether the disclosure meets TCFD requirements or where gaps remain.

The takeaway here is that while ChatGPT is a handy tool in certain situations, a task like detailed sustainability research and analysis requires a kind of rigour and scale that ChatGPT struggles to reach. Manifest Climate’s assessment is more precise, aligned with updated regulatory guidelines, and based in evidence that can be traced back to the source. With Manifest Climate, this same analysis or comparison can be repeated over and over again, swapping out various companies. Trying the same in ChatGPT would likely yield very different outputs each time.

What can Manifest Climate do better than ChatGPT?

Manifest Climate is not an all-purpose AI tool. It can’t write your emails for you or help you re-design your living room. But if you’re part of a sustainable investment or stewardship team, or you advise clients on ESG strategy, it can handle core parts of your daily workflows.

Pre-investment due diligence

The challenge of pre-investment ESG diligence is usually not about finding information, but about turning large volumes of messy disclosures into a clear, defensible view of risk and performance, fast enough to inform real decisions and build sustainable portfolios.

Manifest Climate automates this process by extracting relevant sustainability data from public filings, private disclosures, and questionnaires, then analyzing it through your chosen frameworks and criteria. Instead of manually reviewing documents or running one-off prompts in a generic AI tool, teams can apply the same methodology consistently across companies, sectors, and deal pipelines.

The result is faster screening and fewer blind spots. Every ESG assessment is traceable back to source material, aligned to your internal definitions, and structured so it can be compared across opportunities. That’s where Manifest Climate moves beyond ChatGPT, which can summarize a document but can’t reliably replicate a due diligence process at scale.

Portfolio monitoring and engagement

Once an investment is made, the work shifts from assessment to oversight. Teams need to know where risks are emerging, how companies are progressing against stated targets, and where engagement should be focused.

Manifest Climate enables continuous monitoring across portfolios by applying the same analytical lens over time. Sustainability disclosures, updates, and new reports are assessed against predefined datapoints and thresholds, making it easier to spot changes that matter, not just volume of new information.

Because the data is structured and comparable, stewardship teams can track progress across holdings, prioritize engagement topics, and document rationale in a way that holds up to internal and external scrutiny. Generic AI can answer questions about individual companies, but it isn’t designed to track patterns, changes, or gaps across dozens or hundreds of holdings in a consistent way.

Benchmarking and research

ESG benchmarking requires like-for-like comparisons. In practice, that’s hard to achieve when data comes from different formats, disclosure styles, and reporting standards.

Manifest is designed to normalize this complexity. It pulls comparable qualitative and quantitative data across large sets of organizations, whether you’re looking at suppliers, peers, sectors, or entire portfolios. Because the analysis is driven by defined datapoints and methodologies, comparisons remain consistent even when the underlying documents vary widely.

This makes research more than a one-off exercise. Teams can identify trends, gaps, and best practices with confidence, knowing that the insights are grounded in the same criteria every time. That’s a level of repeatability generic AI tools struggle to deliver, especially once the scope expands beyond a handful of documents.

💡 Read: The complete ESG automation roadmap for advisory firms

Reporting and compliance

Reporting and compliance are still essential, but they’re increasingly the final step rather than the starting point. Strong disclosures depend on having done the underlying work properly: assessing risk, tracking performance, and understanding where gaps exist.

Manifest supports reporting by turning analysis into audit-ready outputs. Disclosures can be assessed against regulatory requirements such as CSRD or standards such as ISSB, with clear explanations, source links, and confidence indicators attached to each data point. This makes it easier to validate claims, respond to regulator or investor questions, and maintain consistency across reporting cycles.

In practice, this means reporting becomes less about scrambling to assemble information and more about clearly communicating decisions and progress that are already well-evidenced. Generic AI can help draft narrative text, but it can’t provide the structured, traceable foundation that regulators and stakeholders increasingly expect.

A familiar interface, built for serious sustainability work

One reason generic AI tools have been adopted so quickly is the interface. Asking a question in plain language and getting an immediate response feels intuitive, even for complex topics. Manifest builds on that familiarity, but anchors it in sustainability intelligence that’s designed for real-world use.

With Manifest’s built-in agent, teams can interact with their own sustainability knowledge base through a simple chat interface. They can run structured assessments when they need rigor, or ask more exploratory questions when they’re looking for insight. Behind the scenes, those answers are drawn from curated documents, defined frameworks, and expert-validated data, not a generic model’s best guess.

That combination matters. Users get the speed and ease they expect from conversational AI, while still working at the depth and scale required for portfolio analysis, benchmarking, and regulatory work. And because the outputs are structured and exportable, the conversation doesn’t stop at insight. It turns directly into reports, slides, and analysis that can be shared, reviewed, and defended.

Choose Manifest Climate for accurate, actionable sustainability intelligence at scale

While ChatGPT and other generic AI tools are impressive in their own ways, Manifest Climate delivers the accuracy, regulatory depth, and audit precision that sustainable investment teams and ESG consultants need.

For those serious about achieving consistent, reliable compliance, Manifest Climate offers an unmatched blend of AI-driven insights based on your proprietary frameworks and public and private data sets. It’s purpose-built for sustainability intelligence — and once you try it, there’s no going back.