The creditworthiness of high transition risk borrowers may degrade as more ambitious climate policies are enacted

Rabobank is the new poster child for climate transition risk in the financial system. In response to the Dutch government’s June announcement of a plan to slash nitrogen oxide emissions from the country’s livestock sector, the lender downgraded the creditworthiness of its entire €10.3 billion dairy farm loan portfolio.

Why? Because the plan could undermine farming clients’ business models and potentially drive many into bankruptcy. The Dutch government itself admitted that “there is not a future for all farmers within [this] approach.”

The lender’s decision comes with real financial consequences. By downgrading the agri-loans, Rabobank now has to calculate their lifetime expected credit losses. This figure in turn informs the amount of income it has to set aside to cover potential future defaults and missed repayments. On top of this, the firm took a €76 million charge to account for potential losses in the portfolio that its credit models might have missed. These measures all contribute to making agri-loans more onerous for Rabobank to originate and maintain. As a result, it may choose to cut back its exposures or raise costs accordingly.

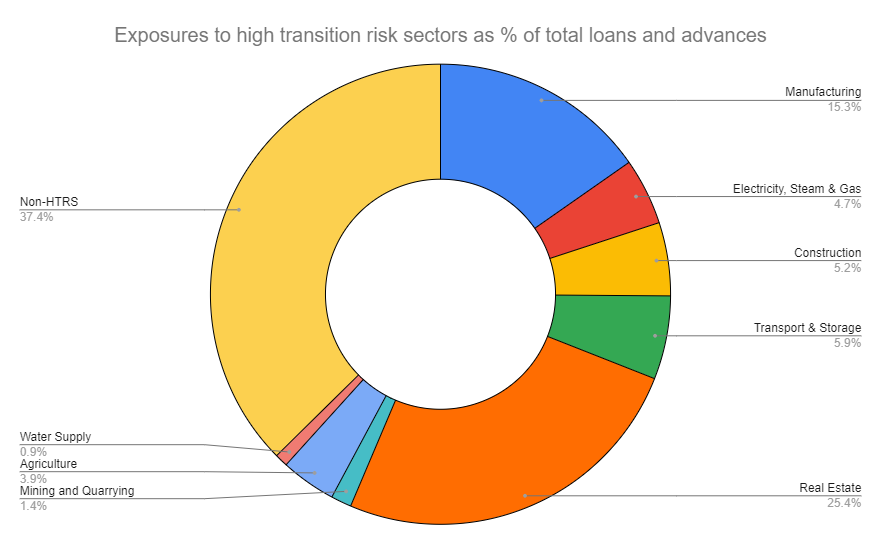

Rabobank’s action could be the first of many among European Union lenders. The bloc’s banks have billions of euros exposed to ‘high transition risk sectors’ (HTRS): those that could suffer financially from the shift to a low-carbon economy.

Source: EU-wide transparency exercise, data as of June 2021

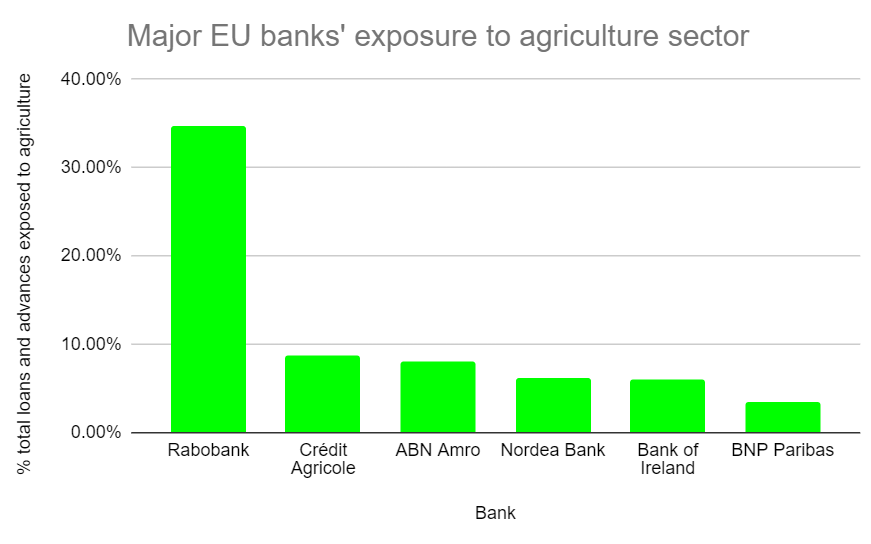

Rabobank’s agri-loans comprise 35% of its total credit portfolio, making it an outlier among EU lenders. No peer bank has as large an exposure. Still, other lenders may have to follow Rabobank’s lead. ING and ABN Amro, two other major Dutch banks, are subject to the same transition risk identified by Rabobank — and therefore may feel obliged to downgrade their (much smaller) agri-loan books, too.

Agriculture is just one transition-sensitive sector, however. Many EU lenders have much larger allocations to other HTRS — especially to real estate and manufacturing. Each HTRS will come under its own kind of financial pressure as the EU implements its flagship “Fit for 55” climate package, which was introduced by the European Commission last year. The legislative proposals it contains are intended to reduce the bloc’s emissions by at least 55% by 2030 versus a 1990 baseline, hence the name. One proposal calls for a 40% cut agriculture emissions by 2030 relative to 2005 levels. Another would introduce an emissions trading system for building fuels in 2024, which could hike costs for real estate.

These proposals exceed the ambition of many EU countries’ current climate plans. Fit for 55 is therefore likely to trigger a forceful policy response from certain member states. Take France. Agriculture accounted for 19% of the country’s emissions in 2020. Though the French government is already taking steps to clean up its farms by improving the management of fertilizers, cutting emissions from livestock manure, and boosting the energy-efficiency of agricultural installations, these policies have been deemed inadequate by France’s own High Council on Climate. This body has called on the government to improve carbon storage on farmland and impose higher taxes on nitrogen-based fertilizers.

Measures like these could pile costs onto farmers and turn some of them into high-risk borrowers. Among French banks, Crédit Agricole had the most agri-loans as of June 2021, with €34.3bn, followed by BNP Paribas, with €14.6bn. These portfolios may be subject to credit downgrades if new policies are imposed. Still, these exposures do not pose an existential risk to either lender. Though the euro amount of agri-loans outstanding is high at both Crédit Agricole and BNP Paribas, these represent around 9% and 3% of their overall credit portfolios, respectively.

Source: EU-wide transparency exercise, data as of June 2021

Real estate borrowers represent a far greater threat. EU bank exposures to this sector made up 25% of their total loans and advances as of last June, and for many lenders real estate loans represent the bulk of their credit portfolios.

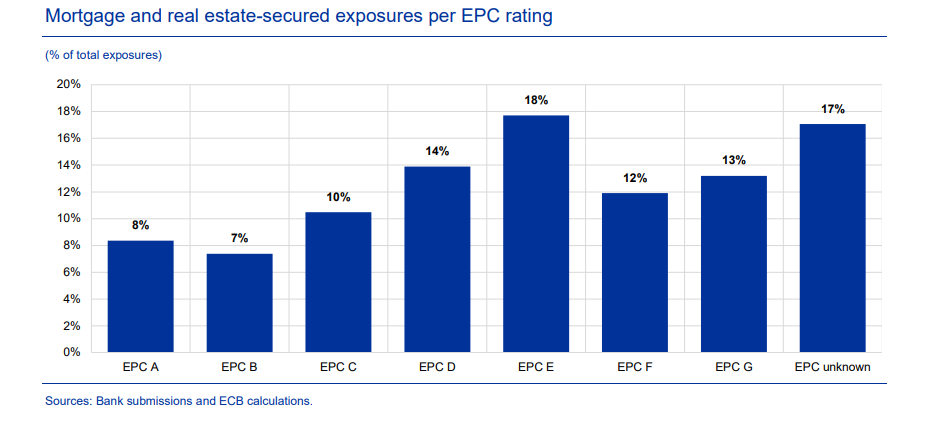

How banks determine the credit quality of these loans through the low-carbon transition will depend on two factors: the carbon-intensity of the underlying buildings, and their owners’ capacity to undertake energy-efficient retrofits. The European Central Bank’s (ECB) recent climate stress test projected that the most polluting buildings would increase in value far less than their more energy-efficient counterparts over a 10, 20, and 30-year time horizon. Many carbon-intensive buildings could even become stranded assets as the EU transitions, which would imperil the creditworthiness of borrowers who pledge these buildings as loan collateral. The ECB found that just 25% of mortgage and real estate-secured loans referenced buildings in the top three Energy Performance Certificate (EPC) classes, while 43% referenced the worst three. Furthermore, for 17% of loans banks had no idea of the EPC class — meaning there could be stranded asset risks lurking in their portfolios that they are unaware of.

Source: European Central Bank

Banks’ blindness to the dispersion of climate transition risk within HTRS portfolios is a problem, and could lead to more bulk credit downgrade actions going forward. Clearly, this is suboptimal. If lenders were better able to segment their climate-sensitive portfolios, they would only have to reclassify bits and pieces of their loan books as vulnerable, and subsequently only have to put aside extra loss provisions for those specific exposures.

Access to high-quality — and highly detailed — data should help with this. The challenge is that a lot of HTRS borrowers, especially in agriculture, are small, unlisted companies which may not be covered by incoming climate-related disclosure obligations. Nor can banks use proxies with any degree of confidence. After all, each farm has its own carbon footprint, unique to its size, livestock, and practices. Similarly, each property has its own energy profile, and each owner a different array of resources to improve its efficiency.

This being the case, there may be no substitute for banks going out and extracting loan-level data themselves. They don’t have to do so alone, however. Rabobank itself teamed up with Barclays and Santander in 2021 to help launch the Banking for Impact on Climate in Agriculture initiative. This aims to close climate-related data gaps in the food, agriculture and land use sectors and “enable banks to more accurately account for agricultural sector GHG emissions.” Over time, the initiative may help banks develop a more granular picture of their agri-loan portfolios and better size climate transition-related loan-loss reserves.

Enhanced loan-level data may do more than help banks avoid painful credit portfolio downgrades. This data could also be used to refine banks’ credit assessments, potentially improving the creditworthiness of certain climate-friendly exposures and making them less ‘expensive’ in terms of loan-loss provisions. For example, the Fit for 55 package includes plenty of financial support for EU member states, such as a “Social Climate Fund”, which could disburse around €72 billion between 2025 and 2032 to help households, micro-businesses, and transport users bear the costs of the low-carbon transition. Much of this would be paid in emissions trading scheme credits for buildings and road transport sectors. With sufficiently granular data, it’s possible a bank would be able to identify the counterparties that are eligible to benefit from public subsidies like these and factor them into their credit loss projections accordingly.

Put another way, the credit impact of the climate transition could cut both ways — darkening the default outlook for some loans, and brightening it for others. This could be true for exposures within HTRS portfolios, as well as between HTRS and non-HTRS exposures. But actioning this level of credit analysis first requires good data, and wealthier banks will likely be better placed to acquire it than their poorer peers.

This dynamic may stratify banks’ climate transition risk management into two approaches. Banks with the most granular data and souped-up models will be able to set aside less income against their HTRS exposures and cherry-pick the least vulnerable counterparties to grow their loan books. Banks without these advantages may have to take the Rabobank approach and reclassify vulnerable portfolios wholesale. It’s an unappealing future for HTRS borrowers and the financial system writ large. No wonder regulators are so keen to get banks the information they need so that they can all thrive in a low-carbon world.