Expanding the definition has brought more assets in scope, but sheds no light on the relative riskiness of different exposures

When the Task Force on Climate-related Financial Disclosures (TCFD) updated its implementation guidance last year, it promoted a host of new and repackaged climate metrics to the financial sector.

One metric favored by the TCFD in its initial guidance in 2017 also underwent a makeover: ‘carbon-related assets.’ This metric was originally conceived as a way to provide stakeholders with an understanding of a financial institution’s exposure to sectors considered the most GHG emissions intensive. However, deciding what is (and isn’t) a carbon-related asset has proven difficult.

Back in 2017, the TCFD had a stab at a definition: a carbon-related asset was any exposure tied to the energy and utilities sectors (as identified using the Global Industry Classification Standard, or GICs), excluding water utilities and independent power and renewable electricity producer industries.

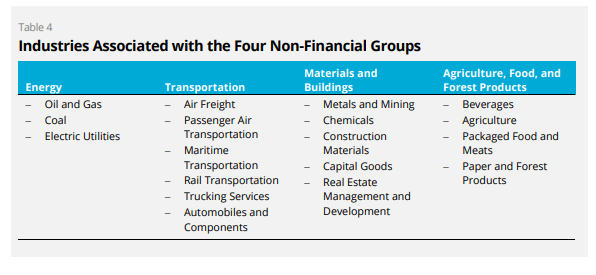

In 2021’s guidance, the TCFD updated and expanded the category to encompass exposures to four non-financial groups determined to be more susceptible to climate risks than others: energy; transportation; materials and buildings; and agriculture, food, and forest products. It also provided a list of industries associated with these groups — 18 in total. However, the TCFD made clear this was not a rigid taxonomy, stating that there may be “industries or sub-industries that are appropriate to exclude” like water utilities and renewable energy producers, and encouraging financial institutions to “describe which industries they include” in their individual disclosures.

Source: TCFD

The definition’s overhaul therefore had the effect of dramatically expanding the scope of carbon-related assets while failing to harmonize the categorization across firms.

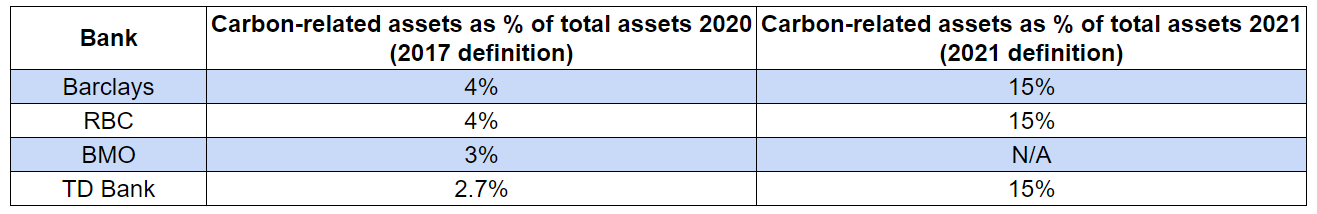

This can be seen in the latest crop of bank TCFD reports. Take Barclays. Carbon-related assets accounted for 4% of its total loans and advances and loan commitments in 2020 under the 2017 definition, and a whopping 15% in 2021 under the latest definition. The bank’s 2021 calculation includes exposures to 22 sectors, of which the majority belong to the material and buildings non-financial group. Significantly, Barclays notes that because the TCFD’s 2021 guidance does not reference GICs, it used its own Barclays Industry Classification Standard instead.

Canada’s RBC offers another example. In 2020, carbon-related assets made up 4% of its total credit exposure under the old definition. In 2021, under the new definition, they made up 15%. Like Barclays, RBC says the lion’s share of its 2021 total is attributable to material and buildings exposures. However, it did not spell out which standard it used to classify exposures.

Not every bank to have recently released a TCFD report, though, has adopted the definition. In its latest disclosure, Canada’s BMO stuck with the 2017 categorization, claiming that it is “updating its methodologies to calculate carbon-related assets and will consider how to incorporate the new guidance in future reporting.” Its exposure to carbon-related assets as of 2021 was 1.9% under the outmoded definition, down from 3% in 2020.

Source: Barclays, RBC, BMO, TD Bank

This trio of disclosures shows how the TCFD’s 2021 guidance has done little to clarify the concept of carbon-related assets. Quite the opposite, in fact. By expanding the range of exposures captured by the definition without prescribing a classification standard (like GICs) the TCFD has given financial institutions greater discretion to pick and choose what exposures can be considered carbon-related.

The new definition has also shifted the focus of the metric away from the true ‘carbon hogs’ in institutions’ portfolios. By capturing sub-industries that are far less carbon-intensive than the energy and utilities sectors — like beverage manufacturing and real estate management and development — it threatens to water down stakeholders’ understanding of the key carbon risks facing banks and other firms.

Some banks, like Barclays, are continuing to offer a granular breakdown of their carbon-related assets under the 2021 definition, so it remains possible for third parties to see their direct exposure to fossil fuels. Others, like RBC and TD Bank, however, do not provide this degree of transparency.

More importantly, though, the new definition does not address a key shortcoming of the old one — its detachment from traditional financial risk measures. As a sector-based metric, it’s helpful to stakeholders wanting to understand a firm’s exposure to what the TCFD considers to be industries subject to elevated climate risks, but it does not tier these exposures by how likely they are to default and how big the financial losses would be as a result. Without this, it’s impossible to understand just how much of a threat the carbon-related assets held by an institution could be to its capital base.

Of course, assigning risk-weightings to carbon-related assets is a tricky task. Since the past is no guide to the future when it comes to climate change, forward-looking scenario analysis is the only reasonable way to estimate the relative default probabilities and potential losses of different exposures. But when it comes to climate transition risks, because there are multiple paths that governments, sectors, and individual firms can take to decarbonize, it’s difficult to confidently adjust an exposure’s risk variables so that it captures all the ‘what ifs?’

Still, it’s not as if such a task would be completely alien to banks, at least. Today, those operating under IFRS 9 accounting standards (or Current Expected Credit Loss in the US) calculate the size of required loan-loss reserves each reporting period using forward-looking economic scenarios, which include upside, downside, and severe downside iterations. The actual amount of set-asides extracted from income each period factors in data from all these potential future pathways. Banks could weight the climate transition risk sensitivity of each carbon-related asset in a similar manner.

Besides the calculation headache, though, it’s also challenging to tease out climate-specific transition risks from what could be termed the ‘traditional’ policy, behavioral, and technology risks that institutions may already be taking into account. As financial risk expert Tony Hughes argues, businesses have always faced threats from new laws, changes in societal preferences, and technological innovation. These should be baked into financial institutions’ existing risk models, and already influence the default and loss probabilities that banks assign to their corporate borrowers.

Climate-specific policy, technology, and behavioral factors may not be captured, however, because of an underappreciation of their qualitative differences vis-a-vis these ‘traditional’ business risks. After all, the raft of responses required to properly mitigate climate change has to be wider-ranging, and enacted over a shorter time-horizon, than for any other policy objective short of fighting and winning a major war. This is the insight that led to the formation of the Inevitable Policy Response, a consortium backed by the Principles for Responsible Investment which has assessed that governments will have to take increasingly “forceful, abrupt, and disorderly” measures to tackle climate change and is providing tools and guidance for the financial sector to better understand the economic fallout.

To arrive at a meaningful understanding of the risks of carbon-related assets, institutions have to try and identify these climate-specific factors through scenario analysis and then work out the extent to which they adjust default and loss probabilities above and beyond ‘traditional’ business risks. Certain climate risk management tools are attempting to do just this, like Transition Check from the UN Environment Programme Finance Initiative and Oliver Wyman.

However, at the TCFD level it’s unlikely there will be a further fleshing out of the carbon-related assets definition to incorporate riskiness. Indeed, the Task Force arguably placed more emphasis on new metrics like portfolio temperature alignment and financed emissions in its updated guidance. It’s a shift that didn’t escape financial institutions — Barclays, BlackRock, BMO, HSBC, RBC, TD Bank and many more all disclosed financed emissions methodologies and preliminary figures for certain portfolios in the latest round of disclosures. Of course, these institutions’ involvement in various UN-backed net-zero alliances also prompted them to lay out these figures.

Having become eclipsed by these other metrics, there’s now uncertainty as to what carbon-related asset measurements are for. Are they a way to make institutions disclose their fossil fuel holdings? If so, then expanding the metric to include other non-financial groups does not make sense. Are they a means to alert investors to the scale of firms’ climate transition risks? If ‘yes’, then why does the definition not call for a breakdown of these assets by riskiness? Are they supposed to harmonize metric disclosures across institutions? Clearly not, since the TCFD only encourages firms to use a consistent definition and does not prescribe one itself.

In light of these shortcomings, the utility of carbon-related asset disclosures is questionable, and their future role in climate-related reporting in doubt.