Business risks and opportunities are shaped by all kinds of factors. A key development over the last decade or so has been the growing awareness of how environmental factors present financial risk to the global economy. This understanding informed the creation of the Task Force on Climate-related Financial Disclosures (TCFD) in 2015 and the Task Force on Nature-related Financial Disclosures (TNFD) in 2021.

The main objective of the TCFD and TNFD is to bring transparency to capital markets on how climate change and nature loss can impact organizations’ financial positions. The frameworks seek to do this by developing decision-useful disclosure recommendations for organizations. Over time, the frameworks hope that the practice of disclosure will lead organizations to integrate climate and nature loss into their risk management and strategic planning. Another hoped-for outcome is that investors will use these climate and nature disclosures to shift capital toward activities that are climate and nature positive.

In the years since its founding, the TCFD has grown to become the world’s premier climate reporting framework, with over 4,000 supporters globally. It now underpins mandatory disclosure rules that are already in effect, or soon will be, in the US, UK, Canada, the European Union, and New Zealand, to name a few.

Organizations that have recently grappled with the TCFD may be wondering how to integrate the TNFD framework into their climate reporting. This blog will describe the key similarities and differences between the two frameworks, and how they are being adopted worldwide.

How are the TCFD and TNFD organized?

The TNFD and TCFD share many similarities, not least the letters in their respective acronyms. However, in terms of how they came to be established and organized they are very different.

The TCFD was set up by the Financial Stability Board (FSB), a panel of global financial regulators, following a request from the G20. Michael Bloomberg, founder of Bloomberg L.P., serves as the organization’s chair. Though the TCFD is industry-led, its link to financial regulators and authorities through the FSB made it the go-to framework for governments working to develop mandatory climate disclosures.

In contrast, the TNFD was founded by a host of financial institutions, corporates, and market services providers, and is not formally connected to the FSB or G20. However, it is funded by public agencies from multiple jurisdictions including Australia, France, Germany, and the UK. Supranational entities, including the United Nations Development Programme, and philanthropic organizations also provide support. David Craig, the former founder and CEO of financial data service Refinitiv, and Elizabeth Maruma Mrema, Assistant Secretary-General of the United Nations and Deputy Executive Director of the UN Environment Programme (UNEP), serve as co-chairs.

However, the composition of the two task forces is similar. Each includes members drawn from financial institutions, corporates, and market service providers. In fact, 35% of the TNFD’s 40 members are also on the TCFD, and 90% of the organizations they’re affiliated with support the TCFD, too.

Each framework is also run day-to-day by a dedicated secretariat. The TNFD secretariat operates through the UK’s Green Finance Institute, while the TCFD’s is run through Bloomberg L.P.

TNFD vs TCFD recommendations

The TCFD’s success informed the structure of the TNFD beta framework, which was released in November 2022.

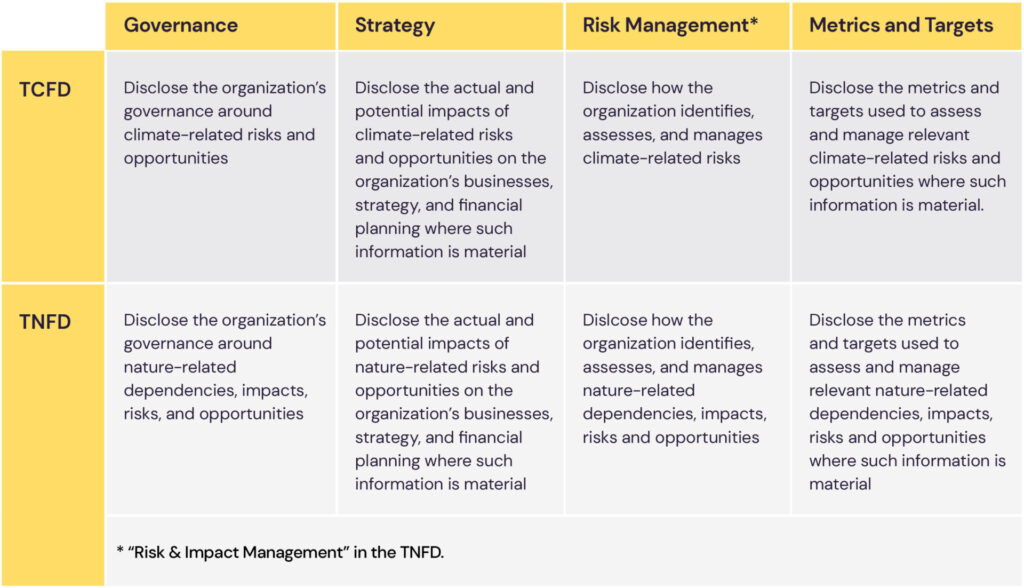

Each framework’s recommendations are organized across four pillars: governance, strategy, risk management, and metrics and targets. While the TNFD has 15 individual recommendations to the TCFD’s 11, most of these align on substance. For example, under their respective governance pillars, the TCFD and TNFD both recommend that organizations describe the board’s oversight of climate/nature impacts, risks, and opportunities.

However, there are differences. For example, the TCFD is focused solely on disclosure of climate-related risks and opportunities, as its name suggests. Meanwhile the TNFD recommendations encourage companies to produce integrated climate-nature disclosures, rather than just nature disclosures, and also to develop appropriate risk management processes. The idea is that TNFD biodiversity and nature-loss data will complement companies’ existing climate disclosures.

Furthermore, the TNFD recommendations cover certain topics that are out of the TCFD’s scope because they are not directly climate-related. For example, the TNFD calls on organizations to consider impacts like plastics in the ocean food chain, changes to soil fertility triggered by land use changes, and air quality deterioration.

The TNFD has promised that as it develops, it will take steps to ensure the two frameworks are “comprehensive and compatible” so that climate-nature disclosures evolve in tandem. At the time of writing, the TNFD is in a “design and development” phase, which involves a series of pilot testing and incremental updates to the beta framework. A final draft TNFD framework is scheduled for publication in March, ahead of the launch of a full framework for market adoption in September 2023.

Who’s adopting the TCFD and TNFD recommendations?

The widespread adoption of the TCFD by organizations in the years following the task force’s founding has encouraged regulators to use the recommendations as the cornerstone for their own climate-related disclosure requirements. The UK introduced climate-related financial disclosure regulations in 2021 that build on the TCFD’s four pillars. In the US, the Securities and Exchange Commission issued a climate risk disclosure rule proposal that explicitly references the TCFD, while in Canada the Office of the Superintendent of Financial Institutions (OSFI) recently finalized a guideline requiring federally regulated banks and insurers to report TCFD-aligned information.

The TCFD also serves as the foundation for disclosure standards under development by the International Sustainability Standards Board (ISSB), which wants to establish a “global baseline” for sustainability- and climate-related financial disclosures.

As the TNFD framework is still in development, it is yet to be adopted by regulators as the template for nature-related disclosure requirements. However, regulators and standard-setters are keeping a watchful eye on its evolution. In December 2022, the ISSB announced it will consider the TNFD’s recommendations on integrated climate and biodiversity disclosures in its own work expanding its climate-related disclosure standard. This implies that organizations using ISSB standards may in the near future have to produce disclosures that align with both TNFD and TCFD recommendations.

The TNFD also received a boost at the 2022 United Nations Biodiversity Conference, where delegates established a Global Biodiversity Framework. This framework incentivizes governments and private organizations to gather data, assess nature-related risks, and set biodiversity targets. In this context, the TNFD recommendations may prove an important tool that regulators will want to use as the foundation for mandatory nature and biodiversity disclosures.

Climate-nature reporting is the future

The TNFD is gaining supporters and attention from influential organizations. Though it differs from the TCFD in certain respects, the TNFD is on a similar trajectory when it comes to institutional adoption and support — the ISSB’s recent embrace of the framework being just one example.

Fortunately for organizations just getting started on nature-related disclosure and risk management, the TNFD is structured to maximize interoperability with the TCFD. Organizations that have already adopted the TCFD and put in place the processes to support climate-related disclosure therefore have a head start when it comes to considering nature-related issues.

How Manifest Climate can help

As the leading Climate Risk Planning solution, Manifest Climate assesses how organizations disclose their climate-related information and identifies opportunities for improvement based on best practices. Learnings from this process can also be used to build out nature-related disclosures. Furthermore, Manifest Climate’s proprietary methodology is aligned with the ISSB, meaning that future updates to this standard — including nature-related disclosure requirements — will be captured. Request a demo to learn more.