One of the main obstacles to meaningful climate action is adequate capital backing. While government policies and incentives are crucial to drive climate initiatives, solutions require support from a broader stakeholder group. The financial sector has been called out as a crucial participant in solving the global climate crisis. Pension funds, banks, insurance companies and investment management firms can drive the transition to a low carbon and climate resilient economy by considering climate in their capital allocation decisions and changing the way they make decisions to finance organizations that are or are not mitigating and adapting to climate change. This shift, of course, should also be good for business and create economic gain for financial institutions and society at large. Luckily, a growing body of market and academic research demonstrate that integrating Environmental, Social and Governance (ESG) factors, including climate, into business and investment decision-making supports both sustainability and financial prosperity.1

Many actors in the financial sector are already exploring the influence of climate-related impacts on their business portfolios. For instance, S&P and Moody’s are considering climate-related impacts on credit ratings and banks are building capacity to analyze the credit impacts of climate-related risks and opportunities as part of the UNEP FI TCFD implementation pilot.

In addition to incorporating climate considerations into investment and credit risk assessment processes, the market is developing new financial products that can specifically address climate-related issues and fund climate solutions. Such products include: environmentally conscious indices; thematic investments; green-themed debt products such as bonds, loans and mortgages; and new ways to securitize these products that allow for access to larger capital-market investors. This blog takes a deeper dive into three of these emerging financial products that are gaining traction in the market: green bonds, green loans and green mortgages.

Green Bonds

Green or climate bonds are one of the more well-known financial mechanisms used by both public and private entities to support climate action. This financial product was pioneered by development banks including European Investment Bank and the World Bank Group but has recently attracted a more diverse issuer base, including municipalities, provincial governments and major financial institutions.

A green bond is a debt instrument that provides a fixed return to its holder/creditor. The proceeds from a green bond issuance are “earmarked” for green projects that support climate change or broader environmental solutions. Standards for green bonds and how to identify eligible green projects are slowly emerging but there is currently no global agreement on these issues. Some of the existing frameworks include the Green Bond Principles by the International Capital Market Association (ICMA), Climate Bond Standards by the Climate Bond Initiative (CBI) and a series of standards under development by the International Organization for Standardization (ISO). Chinese and EU regulators are also participating in green bond standard development. Green bonds must be be certified by external reviewers ranging from organizations such as CICERO and Sustainalytics, to Vigeo Eiris and EY.

Figure 1: Global Green Bond Issuance by Source 2012-2017

Source: Climate Bonds Initiative, 2018

While the green bond market, as compared to the overall bond market, is relatively small, it is growing rapidly. According to CBI, the green bond market issuance totalled U$155.5B in 2017, which represented 2.5% of total bond market and 78% growth over 2016. Main issuers included US, China and France accounting for 56% of 2017 issuance.

Figure 2: Canada’s Green Bonds Issuance by Source 2014-2017

Source: Climate Bonds Initiative and The Smart Prosperity Institute, 2018

Canada’s issuance amounted to C$3.8B in 2017. The issuers were primarily sub-sovereign, development and commercial banks. The largest issuer was TD Bank followed by Export Development Canada and then the Provinces of Ontario and Quebec. The Canadian market appears to be increasing its appetitive for green bonds, especially as an alternative for financing much-needed infrastructure projects. Canada’s green bonds have been often traded at a premium in secondary trading, which suggests strong market demand. At the same time, green bonds tend to cost issuers more due to additional processes associated with issuance, including subsequent monitoring, maintaining, reporting and communication. While these higher costs have led to the slower uptake of green bonds in the Canadian market, they haven’t stopped Canadian issuers entirely. For instance, CPPIB issued its first green bond worth C$1.5B earlier this year. It was the first pension fund in the world to do so.

Green Loans

Green loans are another financial mechanism that is emerging primarily in the European market but is also gaining popularity in the US. There are two types of green loans. The first is similar to green bonds, where green loans are issued to specifically finance or re-financed eligible green projects. Inconsistent taxonomy and definitions of what constitutes an eligible green project, as seen in the green bond space, can also jeopardise the integrity of this market. Standards such as The Green Loan Principles (GLP) by the Loan Market Association issued earlier this year and ISO’s plans to develop green loan standard could be instrumental in providing further clarity.

Another loan product that is related to but distinct from the green loan described above is a sustainability performance linked loan (or “sustainability/ESG-linked loans”). Unlike green loans, which tend to be project-specific, sustainability loans are generally issued for generic uses of the company but their interest rates are linked to the company’s sustainability performance. An increasing number of companies across the EU and the US are utilising this financial instrument, including Danone, Generali, Royal DSM and Gecina. The sustainability-related performance metrics used for these loans include ESG Scores from Sustainalytics, Science-Based Targets and GRESB scores, among others.

Green Mortgages

A group of 37 EU banks, including ABN AMRO, Barclays, BNP Paribas and ING, are currently trialing a mortgage financing mechanism tied to energy efficient properties, also referred to as “green mortgages”. The Energy efficient Mortgages Action Plan (EeMAP) initiative was developed by green building councils in the World Green Building Council’s Europe network and their partners under the EU-funded Energy Efficient Mortgages Initiative. It was set up to test whether energy efficient properties have lower credit risk and therefore offer risk mitigation benefits for banks. EeMAP is based on two main assumptions:

- Improving the energy efficiency of a property can positively impact its value, thereby reducing its risk as an asset from the mortgagor bank’s perspective.

- Lower energy consumption frees up property owners’ disposable income, positively impacting their credit risk scores.

Source: EeMAP Project 2018

As a result, energy efficient or green mortgages could contribute to lowering the risk on banks’ balance sheets. This is of interest to banks as these risk parameters are tied to their capital requirements. This pilot aims to establish large-scale empirical evidence to support these assumptions and incentivize the allocation of private capital into energy efficient investments. Participating banks will explore lower interest rates for mortgages of new build homes in line with the established criteria set up by the pilot.

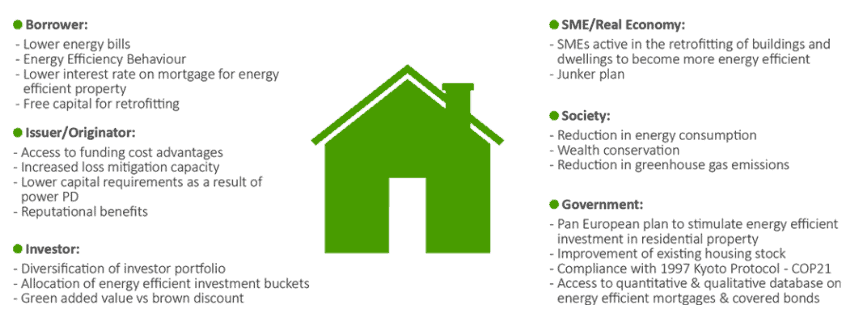

In addition to banks and property owners, this type of program would benefit a broader set of stakeholders:

Source: EeMAP Project 2018

There is a precedent for recognizing the value of energy efficient homes in North America as well. In the US, lenders such as Fannie Mae, Freddie Mac, FHA and the Veterans Administration (VA) consider energy efficiency of homes in their mortgage underwriting guidelines. In Canada, mortgage insurers provide incentives for homes that achieve a certain level of energy efficiency. For instance, Canada Mortgage and Housing Corporation offers a discount on the cost of mortgage loan insurance for owners who buy, build and renovate for energy efficiency using CMHC insurance financing.

Next Steps in Bringing These Products to Market in a Real Way

Green finance products offer important mechanisms to fund the transition to a low-carbon economy and much-needed green infrastructure investments in Canada and abroad. Markets for these products are growing quickly but there are still some kinks that need to be worked out in order to unlock their full potential.

One of the biggest obstacles in the way of these emerging green financial products is taxonomy. As of now, there is no global consensus on what constitutes “green”, “sustainable” or “climate-related.” Clearer definitions and consistent standards are needed. For instance, in Canada alone, it has been estimated that over C$39B worth of bonds, currently unlabeled, would be aligned with “green” or “climate” bond criteria. This is a huge missed opportunity, as these bonds could have access to a more diverse pool of green bond market investors if the taxonomy was more clear-cut.

The global market is seeking to address this issue through multiple forums. For instance, the International Network of Financial Centres for Sustainability (FC4S), that has published guiding principles for the development of definitions, taxonomies and classifications of green and sustainable finance. The European Commission aims to develop climate mitigation and adaptation taxonomies by mid-2019. We need to be thinking about similar initiatives in Canada.

Earlier this year, a federal Expert panel on sustainable finance was formed to “promote awareness among Canadian financial market participants of climate-related risks, consider private sector-led approaches and advance collaboration or through private-public leadership.” In addition, Toronto, as the Canadian center of the financial industry, is being called to consider sustainable finance opportunities more seriously and to build capacity and leadership in this space. In light of the challenges with green taxonomy and the massive opportunities emerging green financial products present, some of the questions that need to be considered include:

- How can the Canadian financial industry be supported by the government to apply climate lens to investment and financing activities?

- What are some of the incentives that government can provide to jump start sustainable finance?

- What are the various regulators’ role in promoting sustainable finance?

- What are some of the promising green projects in Canada that have challenges with financing and how can they obtain better access to capital?