Corporate climate risk is not a simple mathematical equation: It’s also a qualitative concern that’s made worse or better by how an organization prioritizes and prepares for the realities of a changing climate. In the early stages of a climate journey, companies must understand the importance of good climate governance, which can make or break a climate strategy and strongly influence investor confidence.

Investors want to know how companies manage climate risk, yet climate governance is dramatically underreported in corporate climate disclosures. Our Disclosure Benchmark Review of over 3,000 climate disclosures published from 2018 to 2021 revealed that while 43% of companies addressed climate strategy in their reports, only 12% addressed the critical issue of climate governance.

Why good governance underpins climate risk management

Climate risk is not an isolated risk — it affects virtually every part of a business and translates directly to financial risk. The wide-reaching impacts of a changing climate and a transitioning economy also mean climate risk management cannot be an afterthought — it must be a central consideration in every business decision and strategy discussion.

Further, driving corporate climate action is difficult. It requires capital allocation, changes to ‘business as usual,’ and is typically met with resistance. Without leadership buy-in and top-down support for climate initiatives, most organizations won’t move the needle on climate. And without proper oversight, monitoring, and incentives, any initial enthusiasm for climate action is unlikely to last.

“Climate change needs to be addressed by relevant head-office departments, but also as part of corporate strategy managed at the C-Suite level. Relevant metrics and targets will vary across sectors and companies; however, good governance should be table stakes.“

Laura Zizzo, Co-Founder and CEO, Manifest Climate

So, what do investors want to know about a company’s climate governance? And how can companies put better governance mechanisms in place to effectively manage climate risk?

What do investors want to know about your climate governance?

Investors want to know that a company’s board and management team are aware of and are integrating climate risk factors into business decisions. Specifically, they want to know how board members and leaders stay up-to-date on and manage climate risks, opportunities, and performance. The TCFD and ISSB, two popular frameworks and standards for disclosing climate risk management, offer specific suggestions for reporting on climate governance.

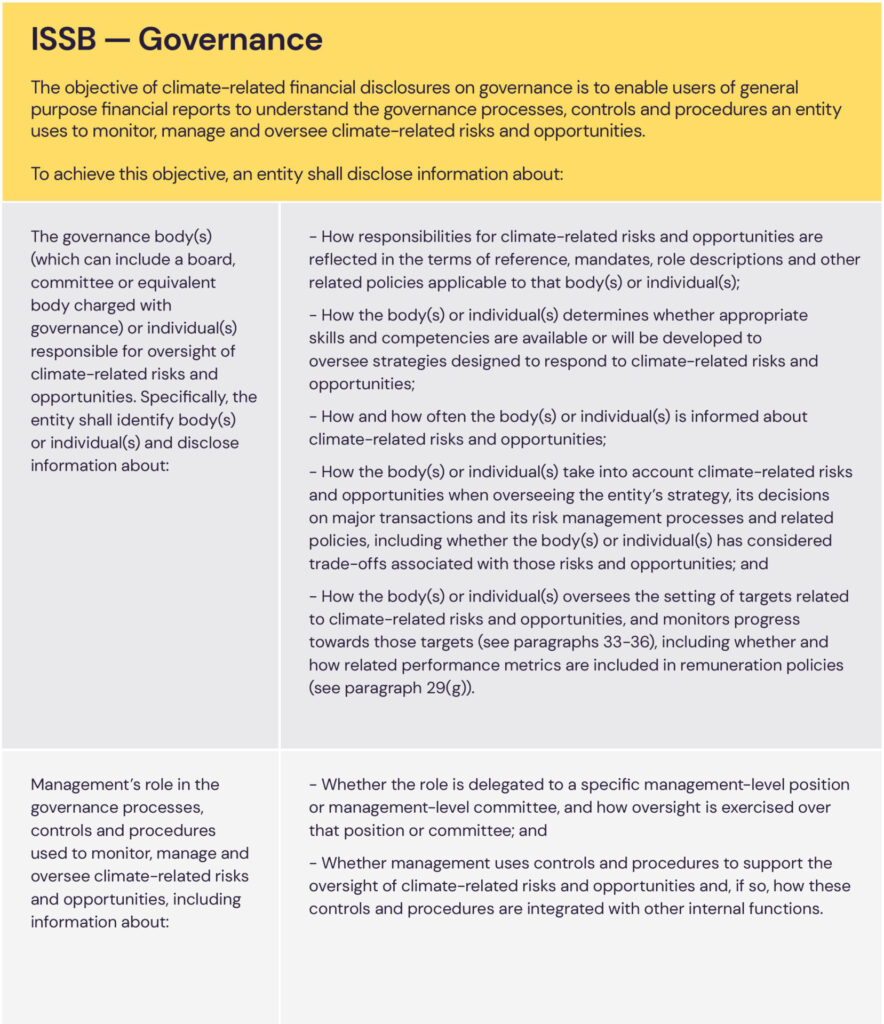

The ISSB’s climate standard, released in June, closely aligns with the recommendations of the TCFD. In fact, the International Financial Reporting Standards Foundation, which oversees the ISSB, recently announced that it will take over the monitoring of companies’ climate progress on their TCFD-aligned disclosures.

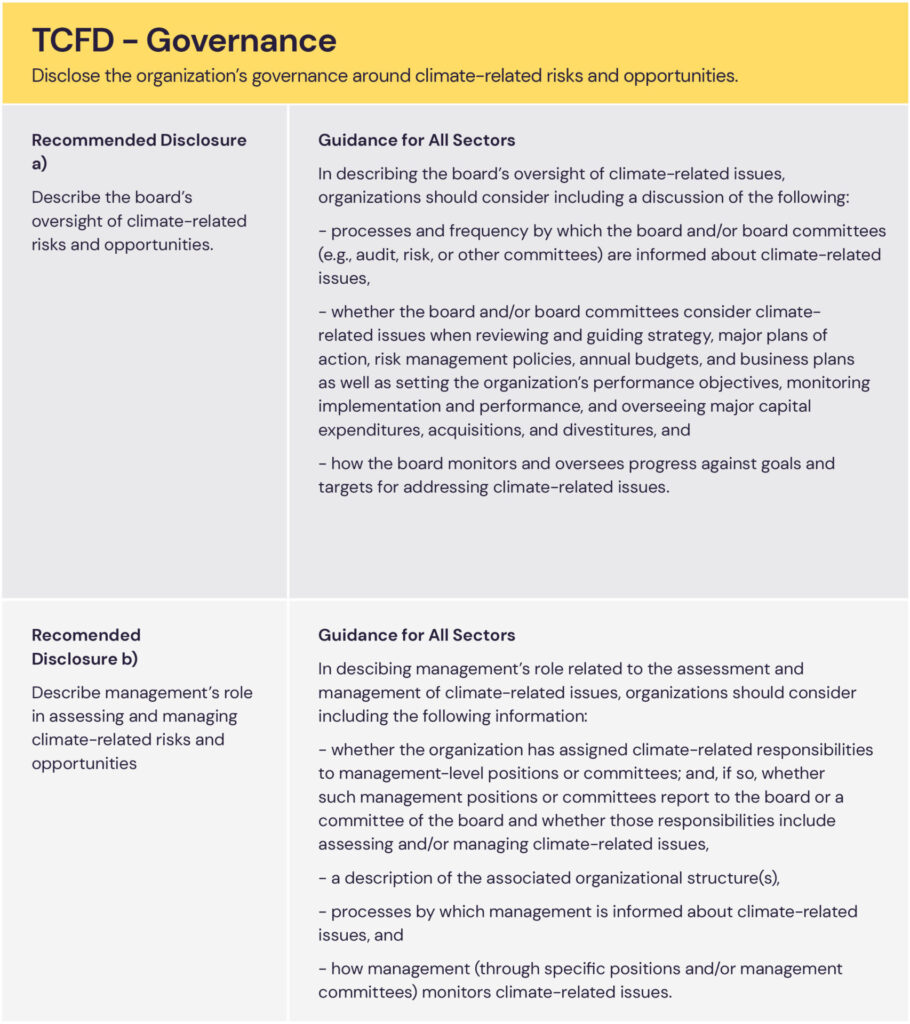

TCFD climate governance

Under its governance disclosure pillar, the TCFD asks companies to:

The more specific you can be when detailing your company’s climate governance mechanisms, the better. Investors want to be assured that the board and management are regularly informed on climate risk and are actively monitoring and managing it. They also want detailed information on the who, what, when, and how of this climate risk management.

“Good governance disclosure is company-specific and provides a sense of authenticity that gives investors comfort because the organization has its attention on fast-moving trends.“

Laura Zizzo, Co-Founder and CEO, Manifest Climate

ISSB climate governance

The ISSB’s climate standard asks companies to detail the following on their climate governance:

How can companies improve their climate governance?

Before you conduct greenhouse gas emissions inventories or set science-based targets, establishing effective governance mechanisms should be your first step on your climate journey. But where should you start?

Working backward from the TCFD’s and ISSB’s disclosure requirements, you should think about establishing:

- Processes: Investors want to know whether climate issues are managed systematically or sporadically. Processes help to ensure better climate management. Investors are looking for processes that cover:

- How the board and management are informed of evolving climate risks and opportunities, including any associated timeframes

- How climate considerations are integrated into existing board-level business strategy discussions

- How climate goals and targets are set, as well as how the board and management are updated on progress towards the goals and targets

- How management reports to the board on climate-related issues

- How to develop or procure necessary climate-related expertise and technology

- Clear responsibilities: Investors want to understand who in your organization is working on climate change and whether those team members are included in all the climate risk management processes. For this, companies should look at:

- Assigning climate-related responsibilities to relevant management positions

- Assigning climate-related responsibilities to relevant management positions

- Accountability: Investors want to know whether and how key players in your organization are incentivized to address climate issues. Companies should therefore look at:

- Developing climate-related remuneration policies to make executive leaders accountable on climate management and action

- Appointing a climate champion to help drive climate action and accelerate your organization’s climate maturity

“There are now many blueprints for action on climate disclosure and steps to achieve climate change preparedness, but it has to start with the collective willingness and courage from directors and managers to look beyond quarterly results and existing annual compensation targets, and toward a sustainable, climate-resilient future where leadership accountability must include climate competence.“

Laura Zizzo, Co-Founder & CEO, Manifest Climate

Manifest Climate knows what your investors are looking for

Manifest Climate is a Climate Risk Planning software that helps companies supercharge their climate strategies. Our platform is the world’s best at assessing climate disclosures. We help to highlight your climate disclosure and management gaps, while providing data-driven recommendations for improvement. We also help your team save up to 75% in manual effort and up to 50% in compliance costs.